39+ fed rate hike impact on mortgage rates

Take Advantage And Lock In A Great Rate. On day later that figure dropped to 6625nbsp.

How Will The Fed Interest Rate Hike Affect You Los Angeles Times

On a macro-level mortgage rates tend to increase or decrease in response to the overall health of the economy the.

. Web The fed funds rate affects short-term loans such as credit card debt and adjustable-rate mortgages which unlike fixed-rate mortgages have a floating interest. Web Several factors influence mortgage rates. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

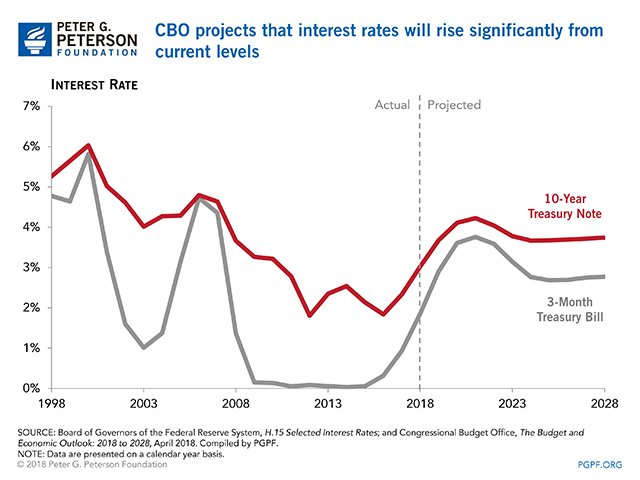

Web While the Feds rate hikes do impact borrowing rates across the board for businesses and families rates on 30-year mortgages usually track the moves in the 10. Web 1 day agoThough the Fed doesnt directly control mortgage rates higher inflation and a higher federal funds rate tend to lead to higher mortgage rates. Web 30-Year Fixed Mortgage Rates.

Web 2 days agoOn November 9th 2022 the average lender was quoting 30yr fixed rates well over 7nbsp. This had an impact on the markets expectations for future Fed rate. Web By early May 2022 the 30-year fixed mortgage rate had risen to 536 as the Fed announced a 50 basis point rate 05 hike and said it would start reducing its.

Web 19 hours agoFebruary 23 2023 1200 PM 4 min read. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Earlier this year mortgage rates soared in tandem with the Feds series of rate hikes edging over 7 for a traditional 30-year loan.

Youll definitely have a higher monthly. Use NerdWallet Reviews To Research Lenders. Its Never Been Easier.

Interest rates on consumer products like home equity lines of credit will increase in. Web 1 day agoIn fact the spike in mortgage rates was driven by economic data beginning on February 3rd. Web The Federal Reserves move to hike interest rates signals good news for the housing sector some experts say.

Other interest rates are built atop the federal funds rate most. Web This announcement puts the federal funds rate at a range of 425 to 45. This is an increase from the.

Take Advantage And Lock In A Great Rate. Web The central bank sets the federal funds rate. Web 22 hours agoThough the Fed doesnt directly control mortgage rates higher inflation and a higher federal funds rate tend to lead to higher mortgage rates.

Web For borrowers and consumers the fed rate hike means that many types of financing will cost more due to higher interest rates. 30-year fixed mortgage rate is 578 percent. The Fed can increase or decrease the money supply in the system through its.

At that rate a 250000 mortgage would cost about 1800 a month including fees. Mortgage rates continued their steep climb this week surging closer to 7 and forcing more would-be buyers back to. Adjustable-rate loans such as.

Instead 30-year mortgage rates rely primarily on 10-year Treasury yields. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad FHA Mortgage Loan Downpayments As Low As 35.

Web After peaking just above 7 in October the average rate for a 30-year fixed-rate mortgage dropped to 599 on Feb. Web The Fed raised its target for the federal funds rate by 025 or one-quarter of a percentage point. Calculate mortgage rates - adjustable or fixed how much you might qualify for more.

That figure has bounced around in the. Complete Your Application Online In Minutes And Be On Your Way. Web On June 15 the average US.

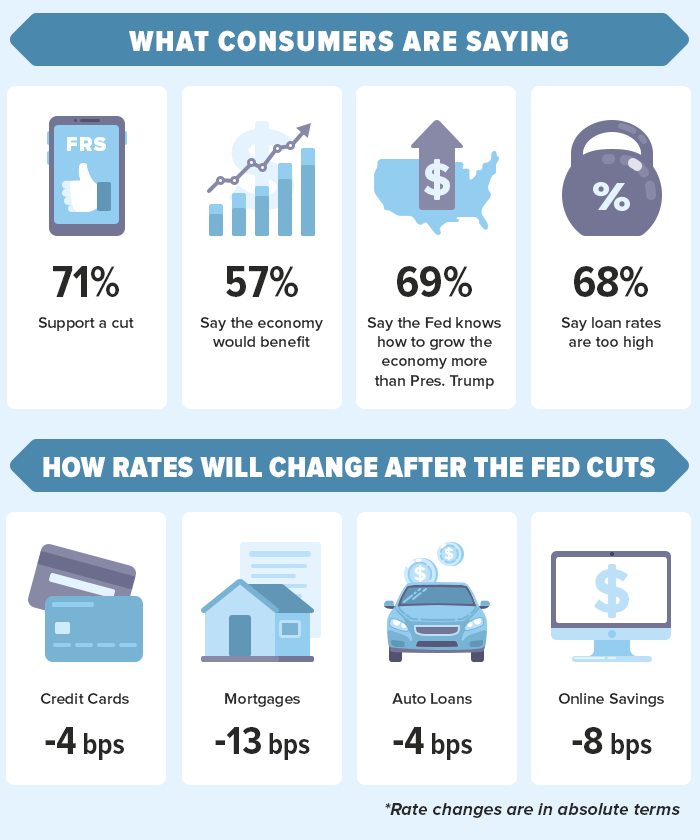

Have a direct impact on mortgage rates the Feds monetary. Get Pre-Approved With MT Bank Today. Web A Fed interest rate cut typically means that variable-rate mortgagesincluding home equity lines of credit HELOCs and adjustable-rate.

Federal Reserve Board Chair Jerome Powell on Feb. Web Impact on mortgage rates. Use NerdWallet Reviews To Research Lenders.

Ad Our free mortgage calculator can help you estimate your monthly house payments. Web The Federal Reserves recent rate hikes wont directly influence mortgage rates but their effect on the economy could push them up or down. Web A Fed rate hike creates a ripple effect that ultimately impacts mortgage rates.

The Feds latest 025. Web The average interest rate for a 30-year fixed-rate mortgage hit 555 this week the highest since 2009 and up more than two full percentage points from 311 at. Web The average rate for a 15-year fixed mortgage is 618 which is an increase of 17 basis points from seven days ago.

Web 2 days agoThe average rate of a 15-year mortgage refinance is 619 an increase from 591 the week prior. The current average 30-year fixed mortgage rate is 632 according to Freddie Mac. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

2 dipping under 6 for the first time since.

Fed Hikes Rates Again As Inflation Slows What To Expect From Rising Interest Rates Cnet

In Depth Us Interest Rates

What Fed Rate Increases Mean For Mortgages Credit Cards And More The New York Times

Current Mortgage Interest Rates February 2023

Federal Reserve Hiked Interest Rates Mortgage Rates Decrease

How The Fed S Interest Rate Hike Impacts Mortgage Rates Fortune Recommends

How Fed Hikes Could Affect Mortgages Car Loans Card Rates Wciv

See What Home Sales Will Look Like Following The Interest Rate Increase

:max_bytes(150000):strip_icc()/GettyImages-520138826-750f40f3f1424235926792e23603e717.jpg)

How The Federal Reserve Affects Mortgage Rates

How Fed Interest Rate Hikes Could Impact Mortgages Car Loans Card Rates

How The Fed S Interest Rate Hike Impacts Mortgage Rates Fortune Recommends

How The Fed S Interest Rate Hike Impacts Mortgage Rates Fortune Recommends

Kaiserslautern American October 31 2014 By Advantipro Gmbh Issuu

October 2019 Fed Rate Cut Probability Analysis

Rising Interest Rates Will Affect Everything From Mortgages To National Debt

Mortgage Rates Could Drop To Under 3 Due To Fed Bond Buying

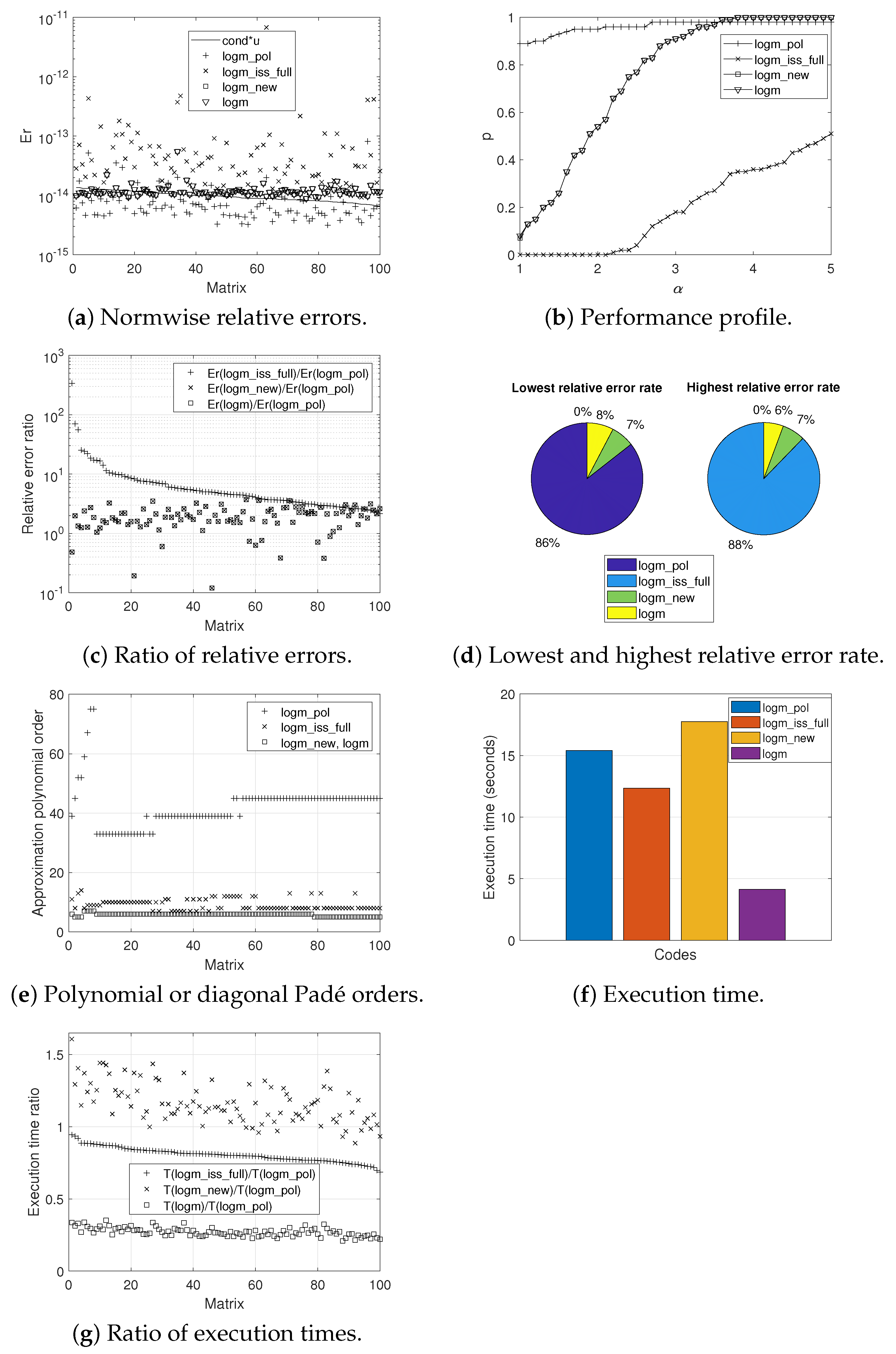

Mathematics Free Full Text An Improved Taylor Algorithm For Computing The Matrix Logarithm